Kyle has done a great job on our portfolio. He has thought of all potential issues the market can have and has safe guarded are portfolio. It very comforting to have those safe guards in place.

Kyle has done a great job on our portfolio. He has thought of all potential issues the market can have and has safe guarded are portfolio. It very comforting to have those safe guards in place.

Our experience with MOKAN Wealth Management has been excellent. Kyle Hammerschmidt has been extremely helpful positioning us for early retirement, creating an easy-to-understand roadmap.

We signed on with Mokan Wealth after attending Kyle's workshops a few years ago and were impressed with the knowledge and experience shared during those classes.

I feel confident and prepared for our future. Kyle is entrenched in the community and has a lovely family. I have shared our financial planning journey with many and hope that Kyle is able to help with their planning as he did ours.

Kyle has been wonderful with our family. We feel confident in working with him. Helped us focus on goals and how he’s going to help us reach them. We like is approach on increasing our investments while lowering our tax burden

Kyle and his team are great to work with. No cookie cutter plans, he takes time to know you and your desires and explains things well. Great teacher... Only wish I started working with him sooner.

You live your best life. We handle the planning and investments. It's what we do best.

.png)

Here's what to expect

Introduction

You’ll schedule a Fit Visit with our team to see what working with MOKAN Wealth looks like.

The Five Seed System

We'll address the five key areas of retirement planning: income, taxes, investments, healthcare, and legacy.

Ongoing Service

We continue to oversee and optimize your retirement plan with regular check-ins and adjustments throughout the year.

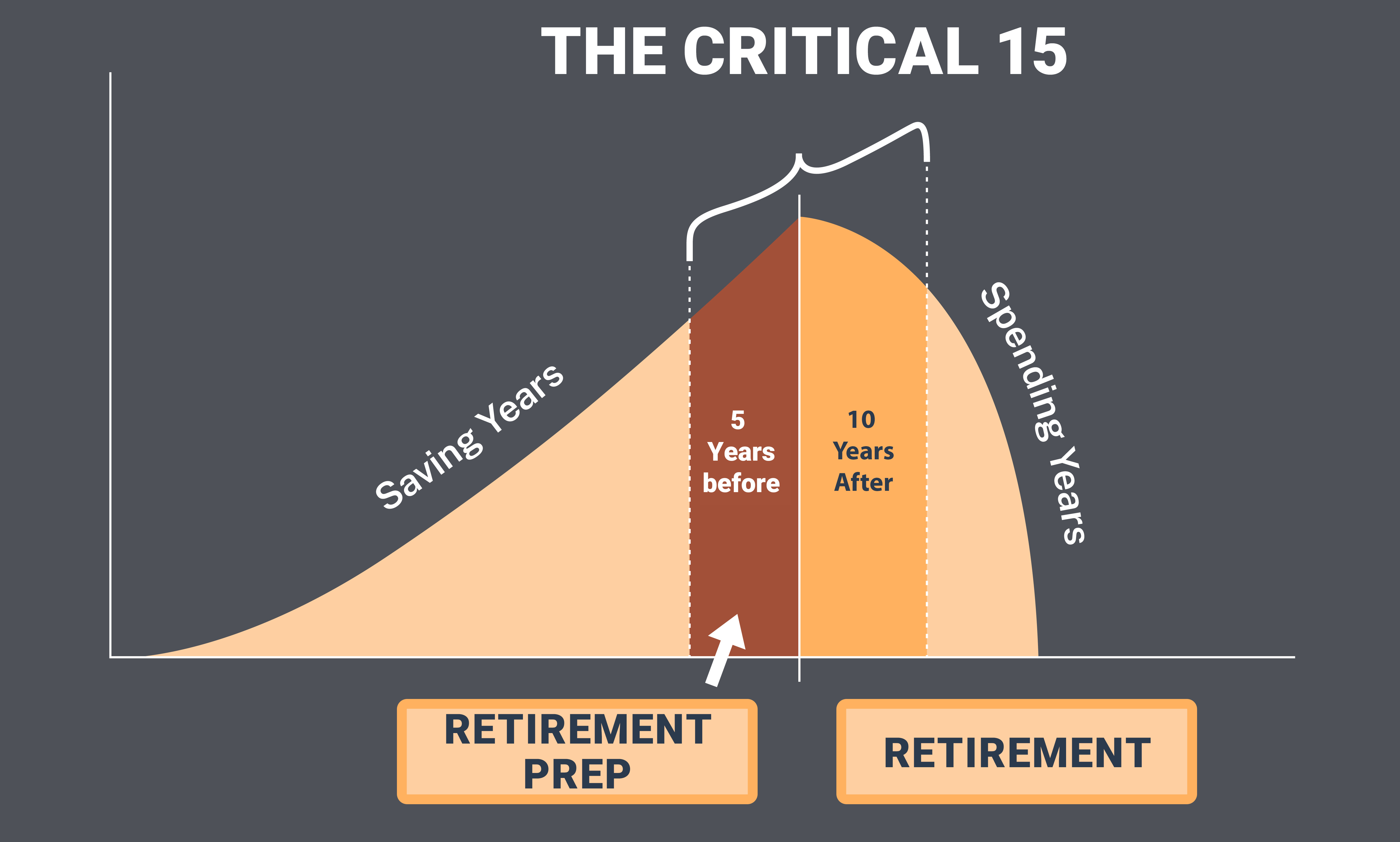

Our Retirement Masterclass is a workshop designed to cover the three main areas of retirement planning: taxes, investments, and income. This workshop is designed for those 45 and up, who are looking to develop a comprehensive retirement plan.

edited.jpg)

Weekly episodes that help you avoid costly tax surprises in retirement, plus smart tips on spending, investing, and keeping more of your money.